Deliver a seamless digital insurance experience with CPaaS

Put an end to slow, costly, and inefficient processes and deliver a seamless, personalized digital claims experience with Webex Connect.

Did you know that the insurance industry puts $170 billion a year at risk due to poor claims experiences?

The insurance industry has, perhaps unfairly, earned a reputation for being somewhat of a laggard when it comes to digital transformation. This includes how it handles routine customer-facing processes such as claims handling and management.

For many insurance providers, the prevalence of siloed working and an often limited, disparate view of the end-to-end customer journey has created a costly, complex, and frustrating experience for customers and agents alike.

In this blog, we’ll explore what’s holding insurers back from delivering a seamless, personalized digital claims experience—and how an enterprise-grade Communications Platform-as-a-Service (CPaaS) can help you get it right.

Recognize the need for digital change

More than ever, customers expect the same connected and personalized experiences from insurers as they do from digital-native brands and services.

Customers between the ages of 18 and 34 express greater interest in digital offerings that help them make safer, healthier, and more sustainable choices. Interestingly, even individuals aged 55 and above are gradually embracing digital interactions with insurers. Many in this demographic express a preference for webchat over the traditional in-office claims process. Customers are also more likely to share their data to receive a personalized service and lower premiums – which can boost customer engagement by 89%. More compelling yet, insurers that offer personalized services report a customer retention rate of 81%.

Individuals aged 55 and above are gradually embracing digital interactions with insurers. Many in this demographic express a preference for webchat over the traditional in-office claims process.

Many insurers are beholden to disconnected workflows and highly complex manual claims processes that only serve to:

Frustrate and alienate customers

Customers are unable to initiate claims using intuitive digital channels and must provide paper-based documentation that can take weeks to process. And because agents have limited agent visibility of historical engagements, customers have to repeat information at every touchpoint.

Accelerate agent attrition

Many agents deal with a high volume of incoming calls and limited access to customer data to help personalize interactions. The combination of frustrated customers and ineffective onboarding damages morale, leading many to leave the job.

Damage trust and inflate operating costs

Without automation and customer self-service tools, the cost of staffing large and inefficient call centers can reduce ROI and limit growth. Plus, the lack of a secure and transparent digital presence makes it harder for agents and customers to detect fraudulent interactions.

It’s time to automate routine processes and empower your agents and customers with seamless and connected digital experiences. Here’s how to make it happen.

Introducing Webex Connect for insurance

Webex Connect is an enterprise-grade CPaaS solution that enables secure, automated, and hyper-personalized customer experiences at scale.

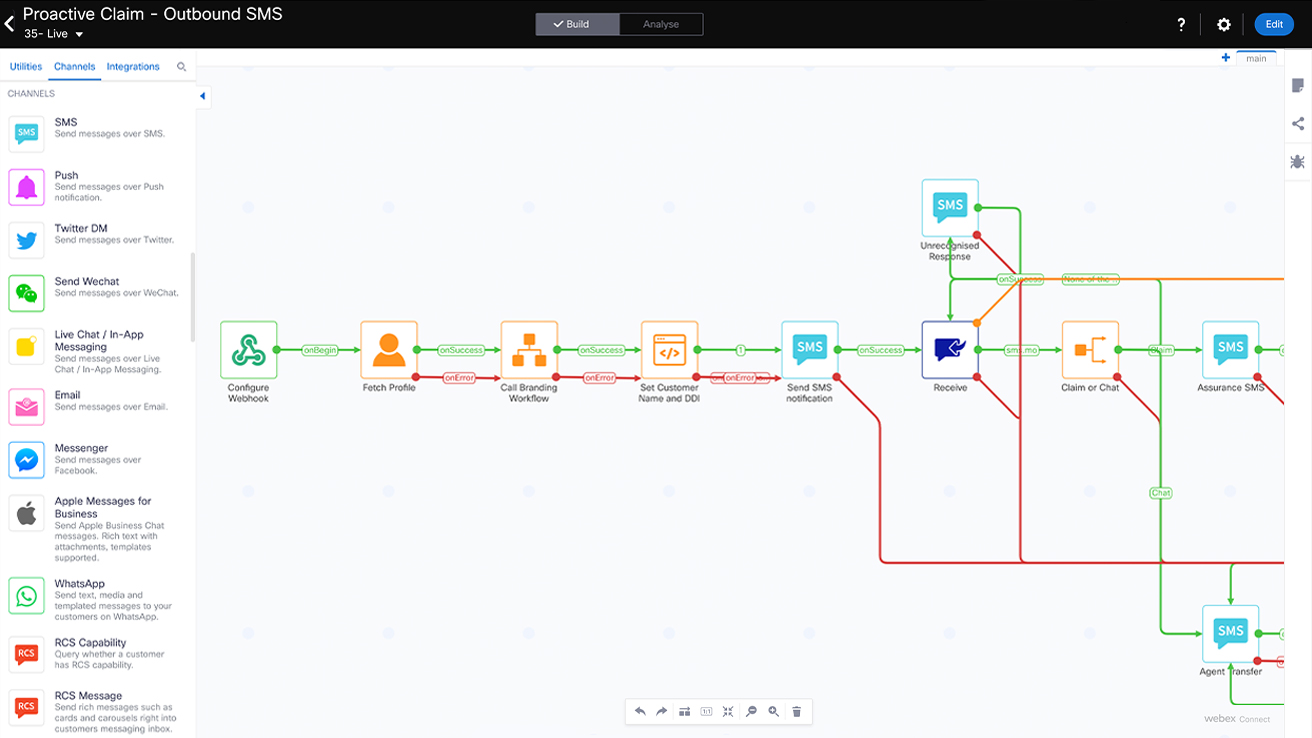

By taking advantage of our cloud communications platform’s diverse API portfolio and custom and pre-built integrations, you can connect your existing backend systems—such as your CRM and policy quote and processing platforms—with the latest digital communication channels.

Plus, by democratizing access to customer data and offering simple drag-and-drop visual tools, your teams can easily build and automate personalized customer journeys. This helps further optimize costs and service team efficiency.

Many of our insurance customers also use Webex Connect to enhance and enable the following use cases:

Claims initiation

Improve your CSAT scores and reduce call volumes by streamlining the claims process and enabling customers to self-serve on digital channels such as WhatsApp. Customers can digitally submit photos, receipts, and documentation in-channel – and manage their claim through automated two-way chatbots. You can also trigger proactive case updates to keep customers informed at all times.

This video shows a customer receiving a proactive notification to submit a claim or chat to an agent due to severe weather through Webex Connect.

Call deflection

Further decrease inbound call volumes through a blend of AI-powered chatbots and call deflection to customers’ preferred digital channels. And by automating responses to the most common queries, you can provide instant customer support and lower the cost to serve, freeing resources for more value-adding tasks.

Fraud protection

Safeguard customer data with two-factor authentication and nurture trust by using secure communication channels backed up by an authentic brand identity. And let customers report signs of fraudulent activity instantly in-chat for added peace of mind.

Agent and customer retention

Simplify customer onboarding and empower agents with intuitive cloud-based tools and dashboards for full visibility of the end-to-end customer journey. Plus, make the most of customer data to cross-sell, up-sell, and personalize coverage to help improve customer retention.

Are you ready to streamline claims processes and deliver a more efficient, profitable, and productive experience with Webex Connect?