Every interaction builds trust.

Create a connected banking experience that builds lasting customer relationships.

How our solutions help.

-

Automate end-to-end customer journeys

-

Confirm identities and profile customers

-

Personalize banking communications

-

Improve payment collection rates

-

Enable customer self-service

-

Proactive fraud alerts

Who we work with.

Innovate the banking experience.

Right moment, right channel

Contextual interactions

Automate real-time marketing, service, and operational communications in response to who customers are, what they are doing, and what they need.

Shift to the latest channels

Embrace two-way digital messaging channels like WhatsApp, RCS, and Apple Messages for Business to promote services, share policy updates, send reminders, and more.

Data-driven communications

Integrate data from customer touchpoints and siloed business systems to create system-triggered journeys that deliver personalized interactions.

Safeguard customers from threats

Combat SIM swap fraud

Combine geo-location checks, mobile network information, and customer behavior to identify SIM swap fraud. Automate follow-up actions such as locking accounts.

Secure customer accounts

Add a layer of security to customer accounts with one-time passwords and two-factor authentication. Unify data sources and conduct third party checks to create an extensive profile of every customer.

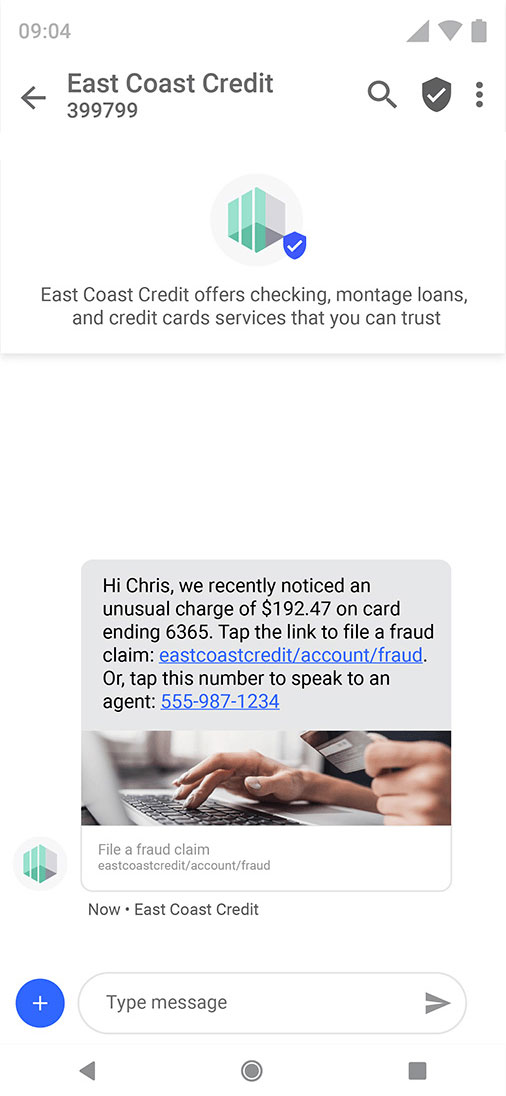

Send fraud alerts

Trigger real-time notifications that validate transactions or confirm suspicious activity with the customer in just a few clicks.

Combat Authorized Push Payment (APP) fraud

We work with fraud, financial and operational decision-makers to analyze security risks to identify solutions and best practice messaging strategies to combat APP fraud.

Customer service made easy

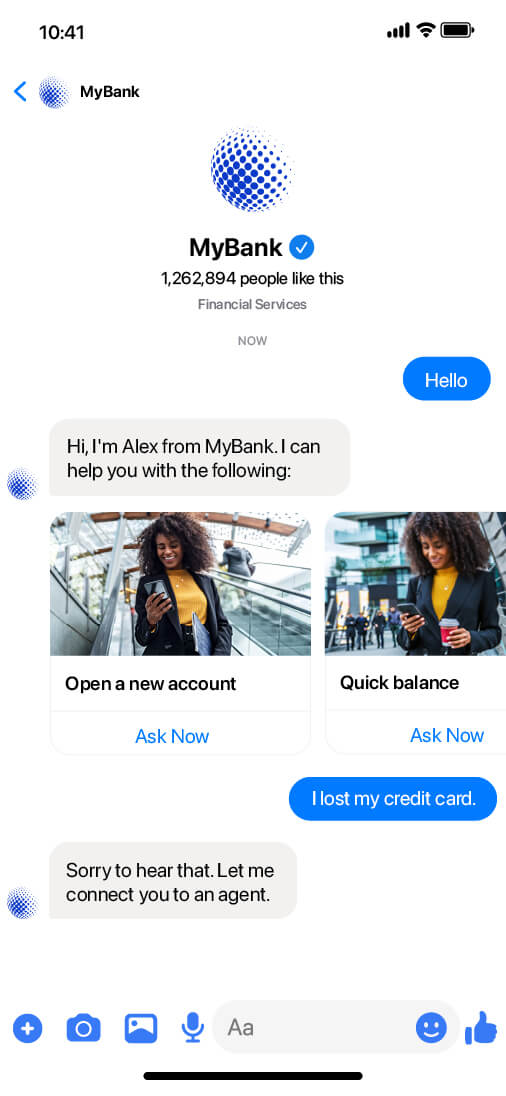

Enable customer self-service

Enable customers to manage their accounts, find out about new services, and quickly solve routine enquiries at any time using chatbots.

Seamless agent handover

Remove the need for customers to switch channels to reach customer service agents. Webex Engage enables agents to manage all customer interactions from one place.

Deflect inbound calls to other channels

Build an IVR that lets customers seamlessly transfer to a messaging channel where they can chat with agents at their convenience.

Seamless payment experiences

Send payment reminders and notifications

Send notifications about upcoming bills through the channel that best results in successful payments.

Let customers pay in-channel

Utilize the latest in-channel payment solutions, such as Apple Pay, to enable customers to pay with ease.

Optimize payment journeys

Create payment collection journeys that direct customers to an app or connect them to a customer service agent so they can fulfill their promise to pay.

IT buyer’s guide for CPaaS.

CPaaS is one of the most exciting opportunities in the cloud communications space. A growing number of enterprises are using APIs, SDKs, and low-code tools within CPaaS solutions to design communications-enabled applications that enhance digital competitiveness. Discover the key features and functionality that you need to look for in an Enterprise CPaaS solution.

Why Webex CPaaS Solutions?

Agile

Launch and modify customer journeys at pace without lengthy developer hours. When required, our team is on hand to help get your customer journeys live.

Integrated

There is no need to rip-and-replace existing systems; our technology integrates with third-party applications like Zendesk and Salesforce to accelerate innovation.

Security & trust

We keep up with the latest FCC regulations and manage information based on TCPA guidelines that are trusted by the world's leading organizations.

Invest in digital channels and customer security.

Talk to one of our experts today.