CPaaS at ITC Vegas - responding to an industry in transformation

We attended the world’s biggest insurtech event, ITC Vegas. Here are the themes and challenges that came through the loudest—and how CPaaS can help you respond.

Contents

Since launching in 2016, InsureTech Connect (ITC) has become the world’s largest insurtech event, offering unmatched networking opportunities to tech entrepreneurs, investors, and industry leaders.

This year, we were lucky enough to attend its flagship event in Vegas and unpack the latest insurance innovations with the industry’s best and brightest. More valuable yet was the chance to hear the prevailing themes and challenges driving the need for proactive digital change firsthand.

In this blog, we’ll respond to the challenges that came through loudest across the three-day event—and explore how the right Communications Platform-as-a-Service (CPaaS) solution can deliver a more efficient and cost-effective digital insurance experience.

ITC Vegas centers on an end-to-end digital future

During our time at ITC Vegas, many told us that the industry was finally starting to orchestrate end-to-end customer journeys built on personalized, cross-channel interactions.

Given that customers increasingly expect the same seamless digital experiences from insurers as they do popular e-commerce brands, it’s a shift that can’t come too soon. Especially when a majority of insurance consumers have an expectation for proactive, contextual and personalized services using the digital channels consumers already broadly use – and that brands expanding to two-way digital communication channels can boost customer engagement by 89%.

It was also encouraging to hear that many firms are realizing the benefit of multi-year application and systems modernizations – making access and integration to real-time data within reach. We did also hear, however, that many insurers continue to rely on multiple systems to manage policy holder data, claims and billing/collections processes – and they are seeking centralized technology and tools that enable expansion into branded omnichannel engagement to offer consumers more choice, flexibility, and control.

Insurers are ready for AI and service automation

Recent years have been challenging for insurers, with already narrow profit margins made tighter by macroeconomic disruption and unpredictable natural disasters. Add inflation and rising property values into the equation, and the cost of claims could—for some—become unsustainable.

In response, many insurers are using AI—a central theme at the event— to automate manual service processes to help optimize resources and reduce operating costs. For example, using customer self-service tools and automated chatbots to field routine interactions—like policy quotes and renewal inquiries—to improve customer retention and ease demand on contact centers.

The insurance industry puts $170 billion a year at risk due to poor claims experiences.

It was also inspiring to see AI used strategically to simplify customer onboarding and enhance decision-making across the end-to-end customer journey—practical applications that deliver real ROI.

And when we consider data we’ve seen that the insurance industry puts $170 billion a year at risk due to poor claims experiences, there is a massive opportunity to transform customer-facing processes digitally – saving money through automation and reducing the risk of losing customers due to poor service experiences.

But how can you make it happen in your own business?

Introducing Webex Connect for Insurers

Webex Connect is an enterprise-grade CPaaS solution that transforms how insurance brands engage and deliver services to customers.

With a vast API portfolio at your fingertips, you can integrate your existing backend systems with the latest digital channels, helping you join the pioneering insurers at ITC Vegas in building meaningful, end-to-end customer journeys at scale.

Once integrated, you can easily access the actionable insights needed to make timely and personalized interactions—all from a single, centralized platform. Additionally, our blended AI lets customers self-serve using automated digital chat that shifts seamlessly to human agents when the situation demands it.

You can also automate contextual alerts and reminders to help keep customers informed of their insurance status, nurturing trust through proactive and attentive communication. Automated updates dramatically reduce the need for agents to take inbound inquiries, freeing your contact center staff to focus on higher-value tasks and interactions.

We understand that orchestrating compelling end-to-end customer journeys may sound like yet another project you’ll need to allocate employee resources for. That’s why we built Webex Connect to democratize CPaaS so technical and non-technical workers alike can collaborate on building rich customer journeys out of the box—all underpinned by simple drag-and-drop visual tools.

This makes it easy for service teams to meet—and even exceed—your customers’ rising expectations, identify value-adding opportunities, and optimize resources to help reduce costs and unlock new sources of revenue.

In this whitepaper learn how composable enterprises and democratized IT can transform CX.

The insurance use cases driving CPaaS adoption

It’s easy to say Webex Connect can transform how you engage and deliver services to customers, but what does that look like? For many of our insurance clients, we see that Webex Connect enables them to:

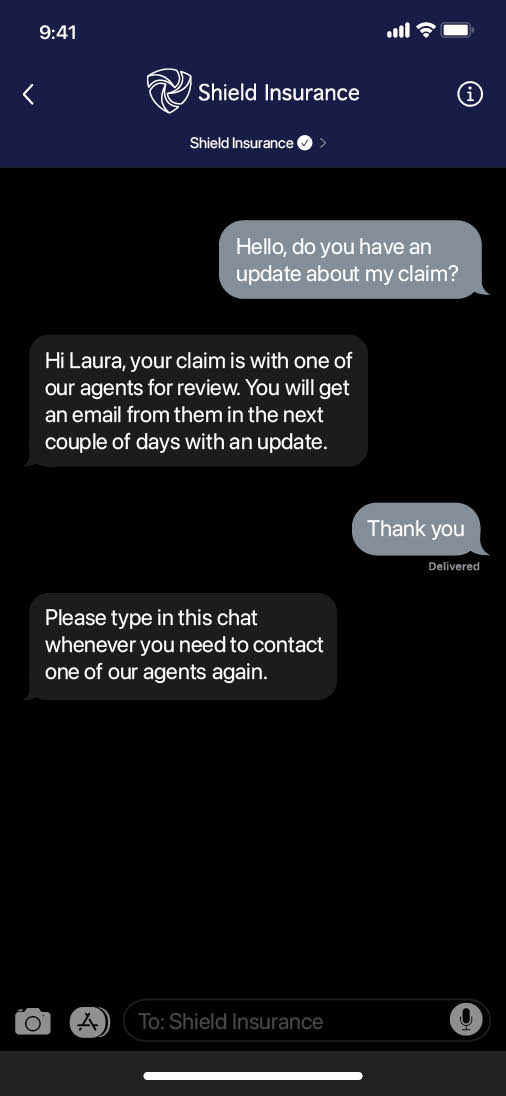

Streamline claims onboarding

Automate customer onboarding by capturing customer information and activating their policies through digital channels like WhatsApp and Messenger. Customers can manage and update their claim details and policies using secure two-way chatbots. Automated updates will also keep them informed of any real-time changes to their case.

Deflect traditional inbound calls

Offer instant access to intuitive AI-powered chatbots and secure messaging on your customer's favorite channels, helping them get the information they need, when they need it. This also frees internal resources, lowering the cost to serve while improving customer satisfaction and retention levels.

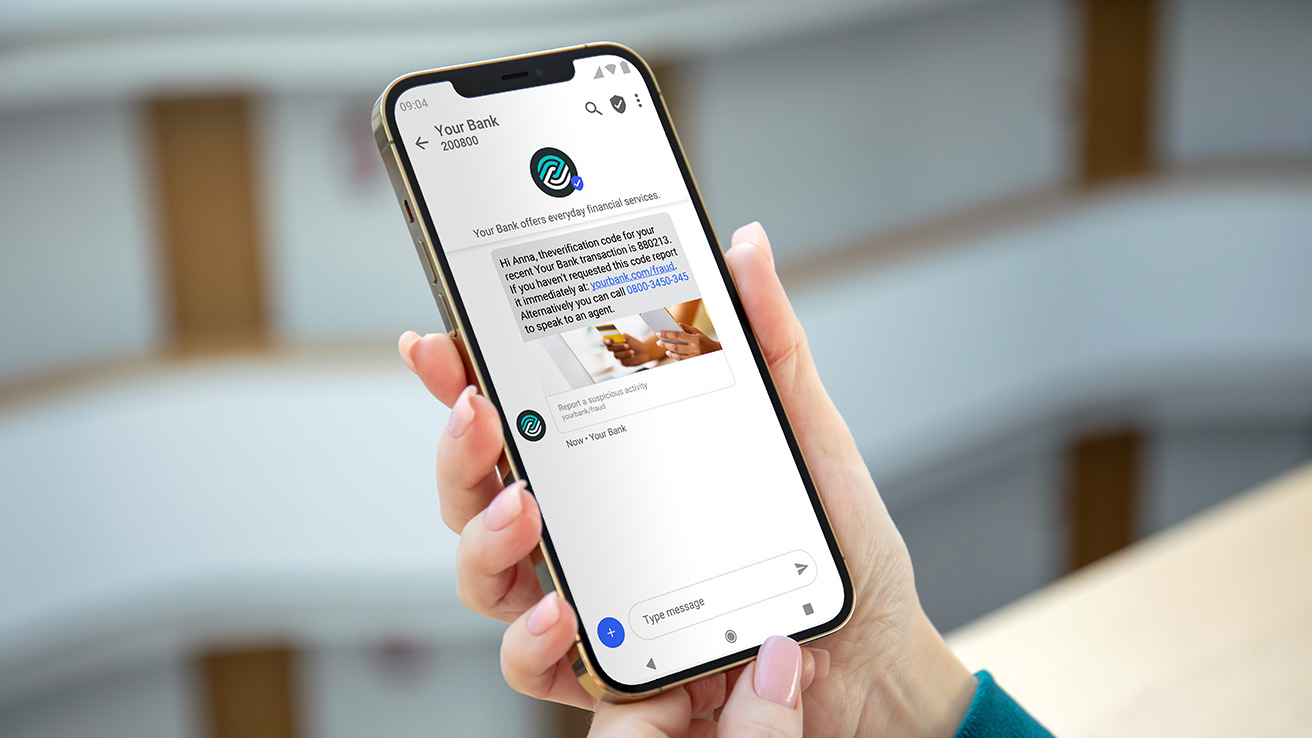

Protect customers from fraud

Apply authentic branding and two-factor authentication for a safe, compliant, and consistent omnichannel experience. Customers can also inform you of any suspicious or fraudulent activity in real-time for fast and effective issue resolution.

Simplify billing and collections

Retire paper- and email-based billing interactions—including payment reminders—that often go ignored or caught in spam folders. Boost renewals and timely payments with personalized, empathetic, and context-aware notifications on the digital channels that customers use most.

Learn more about Webex Connect and ITC Vegas

These are just a few ways the insurance industry uses CPaaS to enhance the end-to-end customer experience, reduce operating costs, and usher in a smarter, more efficient digital future.

To see how Webex Connect delivers a next-generation CPaaS experience for insurance, please get in touch .