Finance firms: it’s time to combat fraud with enterprise-grade CPaaS

Learn how the right Communications Platform-as-a-Service can help finance firms combat fraud with proactive and authentic omnichannel security and branding.

Contents

Hacking, phishing, and identity theft are on the rise as criminals find new ways to exploit and scam a growing community of connected, digital-first customers.

In the U.S., fraud and identity theft cases have nearly tripled over the last decade, with the Federal Trade Commission (FTC) receiving more than 5.7 million reports in 2023 so far alone.

For financial services firms, the fallout can devastate hard-earned customer trust. Plus, 88% of consumers say they won’t use a brand they don’t trust with their data—a necessity to deliver the personalized and joined-up brand interactions they expect.

So, as hacking, phishing, and identify theft grow in frequency and sophistication, what can you do to embed cybersecurity into your day-to-day customer experiences? Let’s take a look.

Enhance communications trust, security and effectiveness with CPaaS

By 2025, 95% of global businesses are expected to use a CPaaS, Communications Platform-as-a-Service solution—unified, cloud-based platforms for orchestrating rich omnichannel interactions.

The best CPaaS solutions include enterprise-grade data protection, role-based access controls, and a centralized view of all communications. Plus, proactive network security that detects and mitigates threats before they have a chance to disrupt operations.

Ideally, your platform will also come equipped with innovative security features that help your teams seamlessly combat fraud and strengthen customer trust.

Here’s how to know if your CPaaS solution is up to the task.

What to look for in a secure CPaaS solution

Whether you’re already using CPaaS or looking at taking secure messaging to the cloud for the first time, we strongly recommend using a solution with the following capabilities:

Branded text and messaging

With your customers receiving potentially thousands of messages through SMS and live messaging platforms every year, it’s crucial they can always recognize an authentic brand interaction.

Too often, sender numbers are randomized or obscured, and many businesses fail to use consistent branding across each channel or interaction. This can cause customers to disregard or even report authentic comms, potentially damaging consumer trust and your brand reputation.

88% of consumers say they won’t use a brand they don’t trust with their data.

Plus, without a consistent brand identifier, this makes it much easier for fraudsters to impersonate your company. And with your brand logo and messaging only a Google search away, they may even be able to create a more convincing copy of your comms services than the real deal.

By choosing a CPaaS solution with dedicated branded text capabilities, you can deliver messages that are instantly recognizable as authentic. You can also nurture confidence by warning customers not to engage with interactions that deviate from your verified branding.

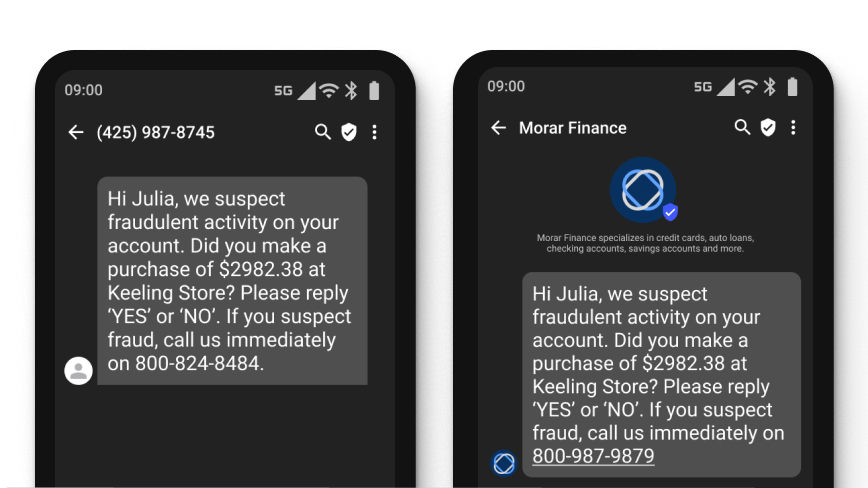

Figure showing an SMS message on the left, on the right Branded Text with a business logo.

Branded text typically includes customizable sender ID and media branding options to help you create a more engaging presence. For example, using verified brand logos and company bios in the conversation header can help counter fraudulent imposters and boost customer engagement.

Proactive fraud management

Resolving fraudulent transactions is not only a costly process, it’s hugely stressful for your customers—so prevention is always the best solution.

With the right CPaaS solution, you can:

Secure customer accounts

Give customers peace of mind with one-time passwords and two-factor authentication, reducing opportunities for fraudulent data access.

Send real-time fraud alerts

Trigger automated notifications that alert customers of suspicious activity, validate legitimate transactions or initiate financial institution fraud workflows with a real-time alerts and actionable, simple customer responses.

Prevent SIM swap fraud

Perform geo-location checks, reference mobile network information, and map routine customer behavior to help identify deviations that indicate SIM swap fraud. Automate follow-up actions to confirmed cases such as by locking accounts and warning customers.

Counter Authorized Push Payment (APP) fraud

Your CPaaS provider will work with fraud, financial, and operational decision-makers to assess security risks and develop secure messaging strategies to prevent APP fraud, a type of scam where individuals or businesses are tricked into authorizing a payment to an account that they believe belongs to a legitimate payee.

Discover enterprise-grade security with Webex Connect

Webex Connect is an enterprise-grade CPaaS solution for automating end-to-end customer communications across multiple channels.

Purpose-built to help financial services firms meet the needs of the connected customer, you can hit the ground running with our custom APIs, low-code visual flow builder, and intuitive AI tools—all underpinned by the five pillars of cloud communications security:

Platform security: Security is layered into every level of our CPaaS solution.

Network level security: Take advantage of a high-performance communications network with built-in redundancy.

Customer identity management: Verify customer identities quickly and prevent service agents from volunteering sensitive data to fraudsters.

Sender verification: Nurture customer trust and drive engagement with authentic branding and verified communications.

Regulatory compliance: Ensure all comms and data processes comply with regional and vertical-specific regulations and policies.

Together, we can help unify, enhance, and protect all your customer interactions in a single, secure platform—reducing costs, complexity, and risk.

To learn more about what Webex Connect can do for your firm, please don’t hesitate to get in touch.