How to create connected banking experiences that build trust.

Inform, connect, and protect your banking customers when and where it matters most to build customer relationships that last.

Contents

Digital and mobile channels have fast become customers preferred way to bank. In fact, 78% of U.S. adults now prefer to bank using a mobile app or website.

At the same time, customers have felt the growing threat of cybercrime. In 2023, UK banks reported losses of $1.2 billion due to phishing fraud, and 80% of customers received suspicious messages impersonating their bank– with global figures being even higher.

This has made the quality and security of mobile communications and digital services a key point of differentiation for banks working hard to win new customers—and keep their existing ones loyal. If a customer learns their friends or family are enjoying a more seamless, secure, and personalized experience, it’s easier than ever for them to move to a competing bank.

In this blog, you’ll learn how Webex Connect can help you create digital banking experiences that protect users, build trust, and help to nurture lifelong relationships with your brand.

Discover the power of joined-up customer journeys

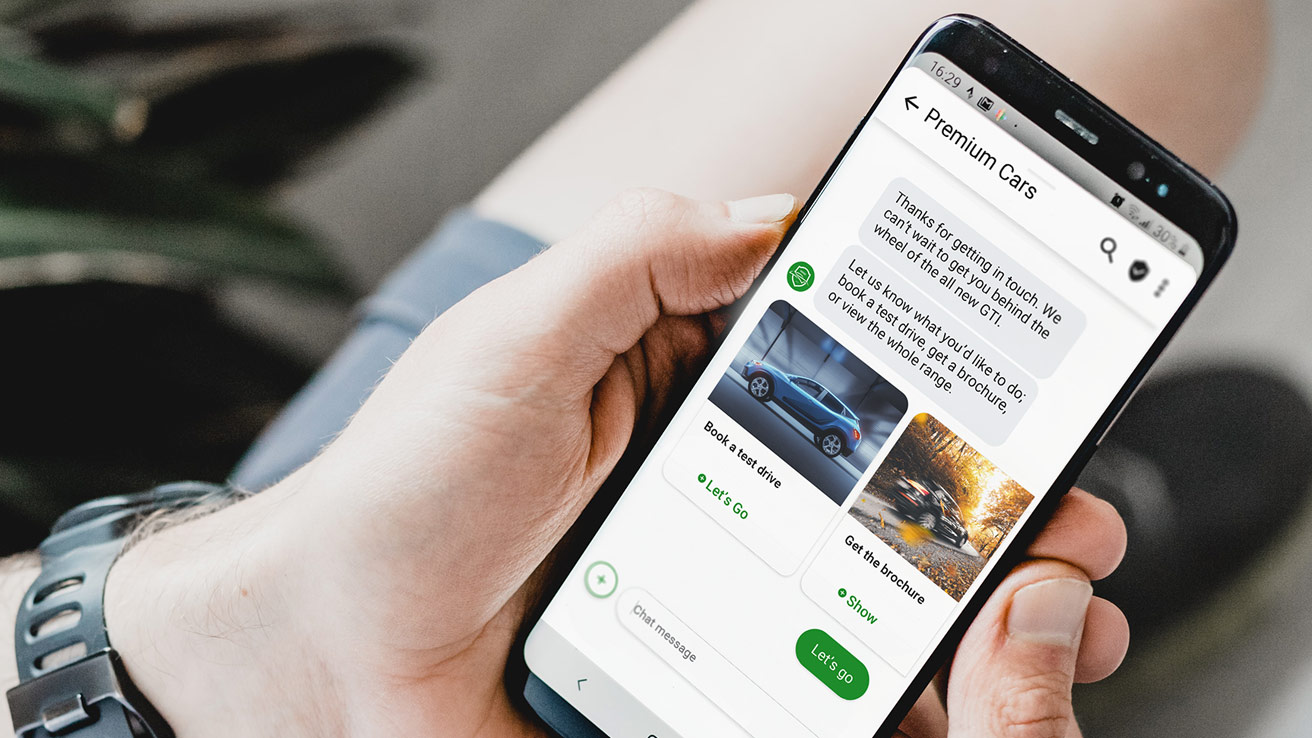

Webex Connect is an enterprise-grade Communications Platform as a Service (CPaaS) that lets you orchestrate contextual interactions across the latest digital channels, such as Apple Messages for Business and Rich Communication Services (RCS).

It provides a 360-degree view of all brand communications in an intuitive, cloud-based platform, enabling everyone to rally around and contribute to the connected customer journey. Let’s take a closer look at how you can use Webex Connect to protect your customers and deliver contextual value when and where it matters most.

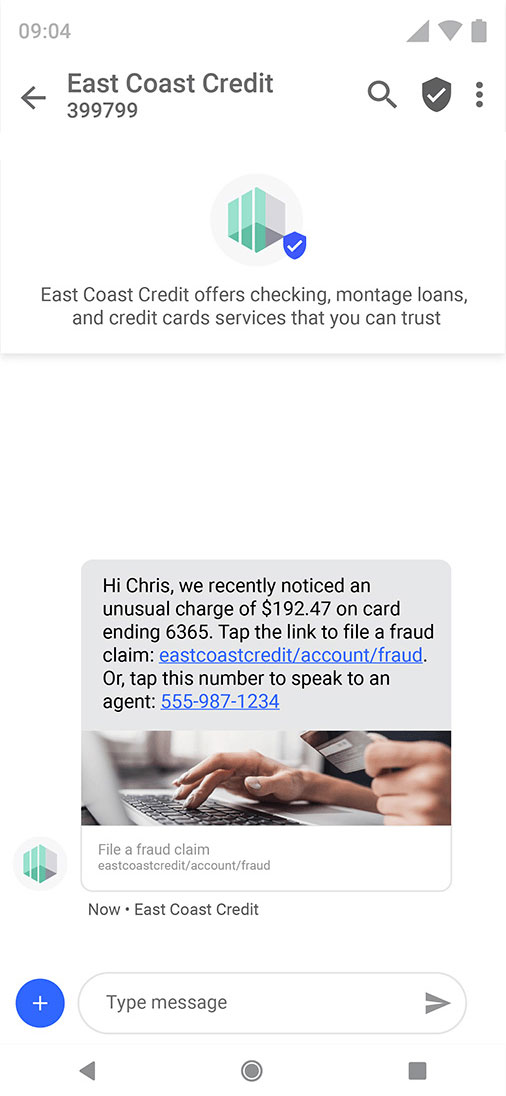

Counter fraud to build trust with Branded Text

SMS remains a great way to reach customers directly with timely updates, contextual notifications, and personalized interactions. But it lacks the rich, app-like features found on many messaging apps, including verified, branded messages.

If customers can’t confirm you’re a genuine business, they may disregard your texts as an attempt at fraud, no matter how well you personalize them. Unfortunately, the inverse is also true, as well-crafted phishing texts may convince them to share sensitive information.

With Webex Connect and Branded Text, you can elevate your SMS journeys to create a richer, branded experience.

Your brand logo will appear in the title bar and conversation window, and a verified sender checkmark will show you’ve been authorized as a real business. Every customer’s device is accounted for too. If their device can’t support the Branded Text experience, they’ll receive a traditional SMS version by default.

Branded Text is natively supported by Webex Connect, so to get started, all you need to do is turn it on. No fussy technical changes or development required.

Take account protection to the next level

You can use Branded Text to send one-time passwords (OTP) and facilitate two-factor authentication (2FA) to helping to increase your customers’ confidence in your security processes.

What’s more, you can automate follow-up actions to alert customers of any suspicious transactions in real-time. Customers can then validate transactions as legitimate—for example, by responding with their PIN—or escalate them for immediate investigation.

You can also combine geo-location checks, mobile network information, and behavioral data in Webex Connect to help identify SIM swap fraud and quickly lock compromised accounts.

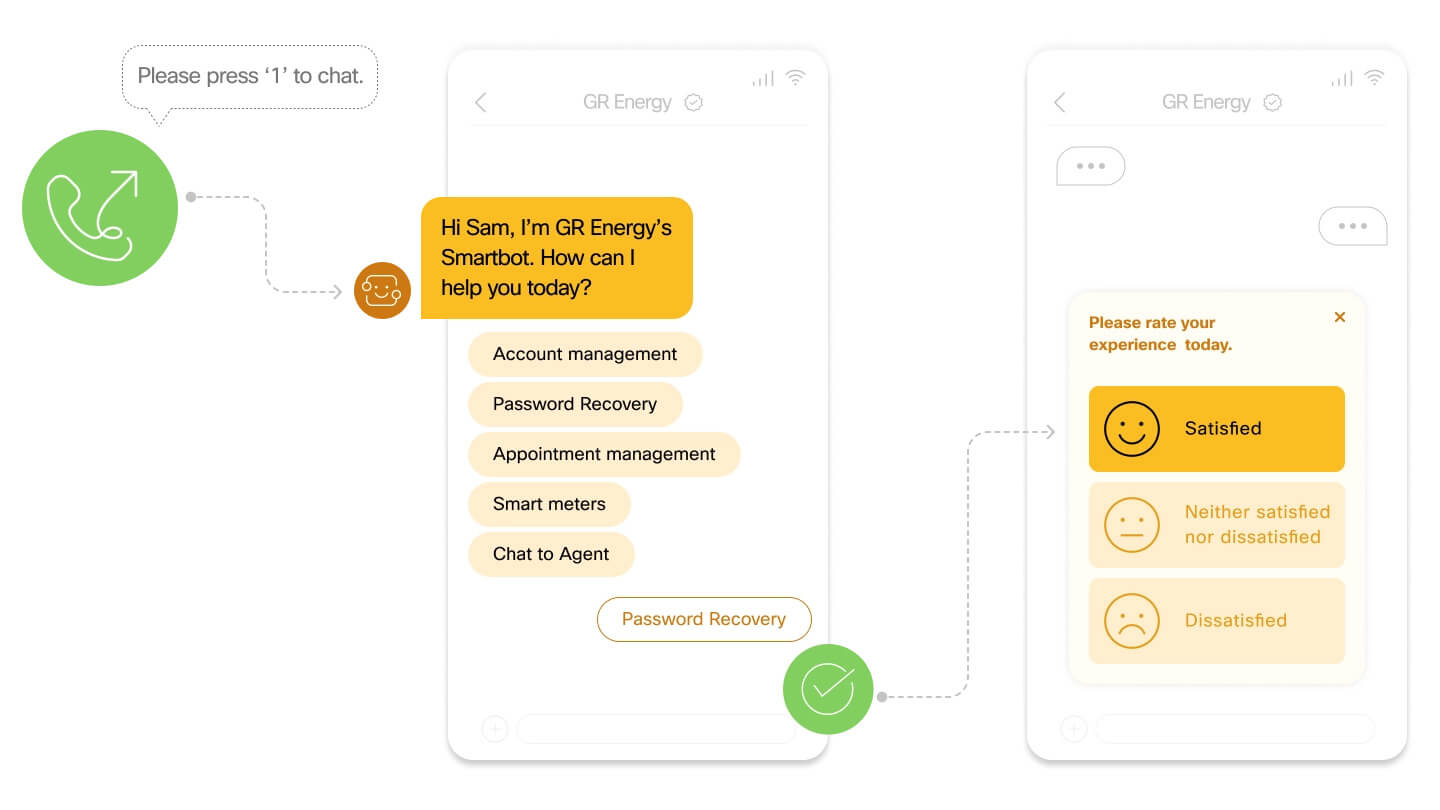

Automate and deflect contact center interactions

Webex Connect provides AI-powered chatbots that can be used across multiple channels. These intelligent assistants can automate routine contact center interactions, letting customers self-serve—anytime, anywhere.

For example, customers may use a chatbot to update their account information, manage recurring payments, or learn more about financial products and services. And should an inquiry prove too challenging or emotionally sensitive for the chatbot, it’ll hand the conversation over to the best qualified live agent.

This helps reduce the amount of time contact center agents spend assisting customers with mundane tasks, freeing them focus on more complex and rewarding customer interactions. For more insight on out how to help customers self-serve check out our call deflection tactics article.

Keep customers informed and reduce risk

With Webex Connect, you can send proactive reminders and notifications to help customers better manage their finances and stay in control.

For instance, warm-up alerts can help prepare customers for scheduled payments and consultations, letting them confirm or reschedule using one-word responses. And with Webex Connect, you can program personalized messages based on the nature of each customer’s unique situation.

Webex Connect easily enables ‘promise-to-pay’ programs, letting customers pay in-channel, confirm payment within the next seven days, defer the payment, or request assistance. If a customer misses multiple payments, the program will send more frequent reminders and link them to professional support services.

According to our own research, 85% of participants pay within seven days of being introduced to the program.

To learn more about our banking industry solutions, and how to create connected banking experiences that build meaningful customer relationships, please get in touch.