How to prevent and reduce Authorized push Payment (APP) fraud

Verified channels stop APP fraudsters from impersonating a bank or payment service provider.

Contents

Consumers lost a staggering £355.3 million to Authorized Push Payment (APP) fraud in the first half of 2021, an increase of 71% compared to the same period last year. It’s become so prevalent that the amount of money stolen has surpassed credit card fraud for the first time, and the vast majority of funds are never recovered.

What is Authorized Push Payment (APP) fraud?

APP fraud is where a person is tricked into authorizing a payment from their bank account to a fraudster. It’s difficult for banks and payment service providers to detect because the account holder approves transfers, so everything appears normal until the victim realizes their mistake.

Fraudsters employ a number of methods to ensure their scams are a success - a mix of social engineering, fake websites, hacking email accounts to monitor activity, and most importantly, communications via messages and calls that appear genuine. They use fear, urgency, and play of people’s emotions to drive action.

APP fraud can be broken down into four categories:

Impersonation scams: When a criminal pretends to work for a trusted company such as a bank, government body, or health official.

Investment scams: When a criminal convinces a victim to hand over money on the promise of a questionable financial opportunity.

Romance scams: When a criminal adopts a fake online identity to gain a victim's affection and trust.

Purchase scams: When a victim pays for goods and services that don’t exist.

Out of the above categories, impersonation scams are the main driver of stolen funds and is the type of APP fraud that companies need to be most aware of as scams directly involve them. If they fail to act or be seen not to be trying to protect their customers, they risk damaging customer trust in the brand and the communications they send.

Start taking action or risk millions in compensation

The Payment Systems Regulator (PSR) announced proposals in November 2021 to combat APP fraud. They outlined actions for greater collaboration and the requirement for banks to publish their fraud data, such as which bank and building society accounts are being used to receive the fraudulent funds.

The significant proposed change driving fraud, financial, and operational decision-makers to prioritize APP fraud is the mandatory reimbursement of victims who have acted appropriately. Therefore, they risk millions in compensation if they fail to take proactive steps to prevent and reduce APP fraud.

Verified channels stop fraudsters from impersonating your company

At the heart of an APP fraudster's arsenal is using calls and messages to trick consumers into believing they are a genuine representative of a company. To take this tactic from them, we are working with banks, payment service providers, and other companies to carefully plan and implement a shift to verified channels for customer engagement.

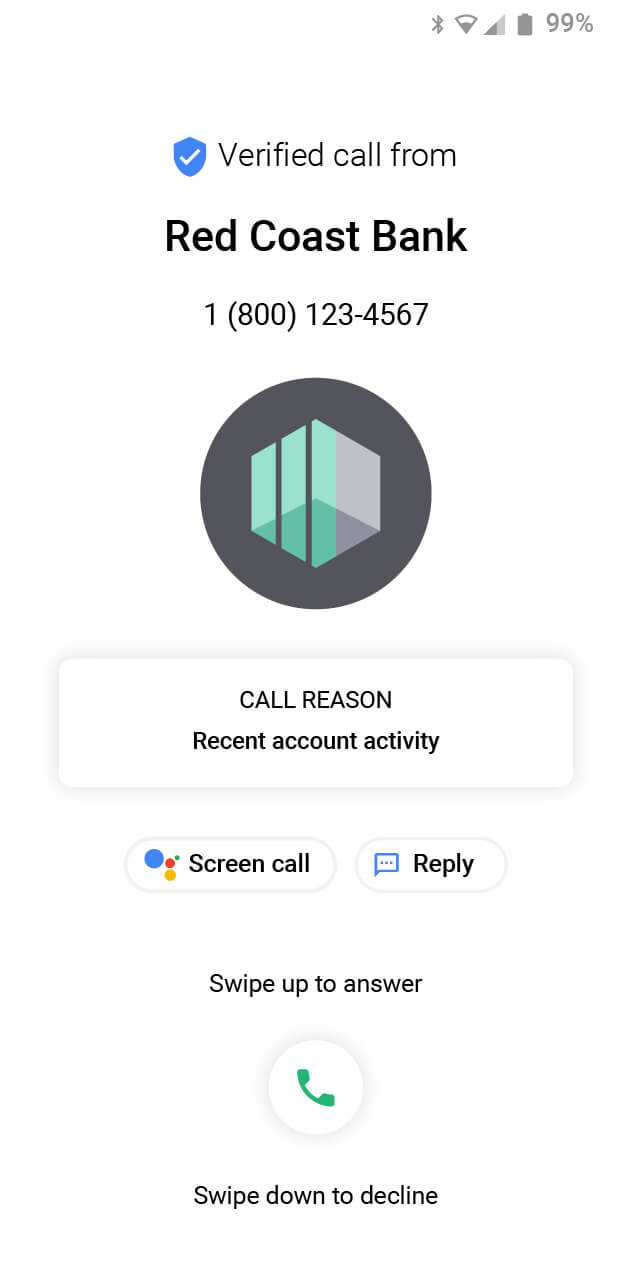

Verified channels add sender verification, reason for contact, and branding to calls and messages. Companies go through an onboarding process with the channel's technology provider, such as Apple and Google, making it incredibly difficult for fraudsters to imitate communications sent over these channels.

The primary channels that should be first on the list for implementation are Branded Text and Verified Calls, as these can be used for proactive outreach to customers. From there, companies can look to explore other options such as WhatsApp, RCS, and Apple Messages for Business.

Customers can trust that the contact over these channels is genuine, whether it be messages or calls. In addition, they can be made aware that communications sent through non-verified channels should be treated with caution.

Educate customers using rich messaging

Alongside adding verification to communication, another key use case for verified channels that we are exploring with our clients is the delivery of proactive educational campaign programs.

As they say, knowledge is power, and the notion can be applied to combatting APP fraud. Verified channels offer rich media capabilities such as videos, images, and documentation. Interactive two-way journeys can be created to equip customers with the knowledge of how to spot APP fraudsters and what to do if they think they are a victim.

As the campaign is delivered straight to a customer's smartphone and is easy to consume due to the use of rich media, it is more likely to have an impact. In addition, such campaign programs will help companies be seen as proactively trying to tackle the issue, leading to an increase in positive sentiment from customers.

RCS enables businesses to style messages and UI components in line with a business' visual identity.

Get in touch to learn more

If you would like to learn more about our APP fraud solutions and how we can help you shift to verified channels such as Branded Text for customer engagement, get in touch with us.