Redefining insurance customer experience to drive growth

What can insurance companies do to stay relevant and deliver meaningful customer experiences in an increasingly digital world?

Sravani Gade

Given the nature of the industry, which is both process-driven and highly regulated, insurance companies have found it hard to keep up with the rapid digitization of products and services.

Consumers today expect businesses to resolve their queries quickly and engage with them on their preferred channels of communication. Companies must meet these growing expectations to retain and grow their customer base or risk losing out to a competitor. The insurance industry, which has seen a 15% fall in profits from 2019, and a 1.2% premium growth rate over the last two years, is under pressure to cut costs and adopt digital platforms to stay relevant and compete with new-age insurers who are increasingly digital-first.

Driving innovation to stay ahead of competition

The insurance industry has seen significant changes over the last decade. Digital advances have streamlined the management of claims, customer onboarding, and fraud prevention processes. In the face of new challenges such as rising competition, increasing operational costs, and supply chain disruption however, insurers are needing to reinvent themselves to meet customer expectations and deliver cutting edge customer experiences.

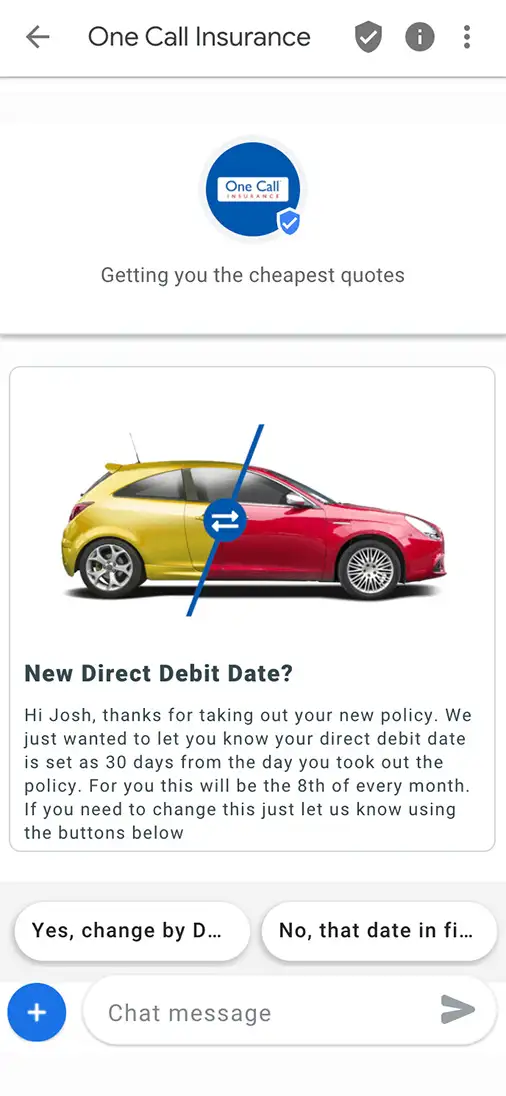

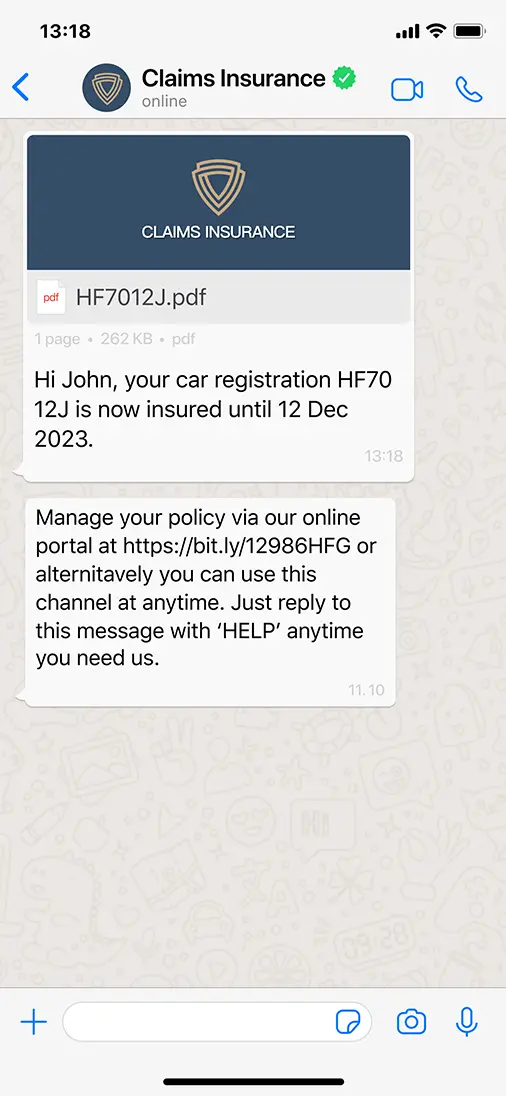

Some insurers have adopted the latest messaging channels to improve how they interact with their customers. Interactive channels like WhatsApp and Apple Messages for Business have become gateways to enable customers to renew contracts, view statements, and be notified of upcoming payments.

Personalizing every interaction you have with your customers is key to building a lasting relationship. Sending proactive reminders about upcoming renewals, sharing policies or leveraging contact history to provide customer support is essential to delivering great customer experience (CX) and building loyalty.

Ensuring a consistent and connected experience across multiple channels is another contributing factor to winning business and customer loyalty. Consumers who get in touch via a website, by calling, messaging or using a QR code should be able to continue or resume the conversation seamlessly at their earliest convenience. Offering customers the flexibility to choose the channel they prefer or deflecting voice calls to a messaging channel they already use, is no longer just a nice to have. Digital messaging channels like WhatsApp also enable businesses and consumers to exchange media directly within the app making tasks like filing a claim quick and easy.

Sending proactive and personalized communications, enabling call deflection that routes voice only interactions to customer-preferred channels, and building consistent experiences across any channel to enhance CX, doesn’t have to be challenging.

Communications Platform as a Service (CPaaS) provides insurers with the ability to manage customer interactions at scale across multiple channels, leverage their existing backend systems and applications, embed automation in customer journeys, and much more to enhance CX.

Leveraging CPaaS to innovate, automate, and orchestrate

CPaaS is arguably the most popular customer communication enabler today. Programmable APIs and low-code development capabilities are some of the key features a CPaaS solution can offer to enable businesses to augment their customer communication capabilities.

Insurers have often cited rigid legacy systems, or significant investments in existing technology as reasons that hinder them from trialing new technology. They fear an increase in operational costs, the allocation of resources to program and maintain new software, and its lack of ability to stay relevant as customer behavior and preferences evolve. CPaaS however offers a whole host of benefits. Insurers can personalize and enhance customer interactions by integrating CPaaS with existing systems and third-party platforms and applications like CRM systems.

NLP and AI led automation capabilities boost a business’ ability to manage peaks in call volumes. Appointment management, proactive alerts, and notifications within digital channels can reduce the need for customers to reach out to contact centers. Chatbots with NLP and NLU capabilities could help customers self-serve and resolve their queries instantly without needing to call an agent.

Insurers can engage customers on a variety of communication channels whether it be voice, email, SMS, or digital alternatives like Apple Messages for Business and Google’s Business Messages that offer rich media features like quick replies, list menus and carousels.

A good CPaaS solution helps insurers reduce operational costs and saves time. Embedding digital channels and automation to their customer communications, allows the business to handle multiple inquiries simultaneously. Contact center agents can focus on more complex or important queries such as fraud detection or policy claims. AI-led chatbots can handle common inquiries at scale while seamlessly handing over to agents when required, without losing the context of the interaction. Its integration capabilities reduce the need for a business to rip out, replace, or re-program its existing technology, saving IT development efforts and reducing costs.

Insurance companies need a CPaaS solution that shields them from the complexities of adding technology to their CX strategy while enabling them to deliver great customer experiences, at scale. Webex Connect, our cloud based CPaaS platform provides insurers with the ability to orchestrate customer interactions from end-to-end. It is a centralized, low-code platform that allows businesses to have a unified view and manage all their customers interactions from one interface.

The platform sits as an added layer within a company’s existing tech stack saving the need to rebuild or develop complex logic to deliver superior CX. Intelligent automation and multichannel capabilities make it easy for businesses to interact with their customers at scale and provide support 24/7. Its flexible infrastructure ensures customer interactions are handled promptly, even when volumes are at their highest. The platform also keeps pace with new technologies to offer latest channels as they emerge. It ensures regulatory compliance across the regions the business operates in, along with measures to protect customer data.

To learn more about Webex Connect and our insurance solutions, get in touch today.